- #EDUCATOR EXPENSES 2020 SOFTWARE#

- #EDUCATOR EXPENSES 2020 PROFESSIONAL#

- #EDUCATOR EXPENSES 2020 SERIES#

#EDUCATOR EXPENSES 2020 SOFTWARE#

If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. Additional fees apply for tax expert support. Additional terms and restrictions apply See Guarantees for complete details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free Worry-Free Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2022 individual income tax return (federal or state). If you have other questions about tax breaks for teachers-such deductible 403(b) Plan contributions -find out how you can work with one of our tax pros! With many ways to file your taxes, Block has your back. Help with tax breaks for teachers–and other deductionsĬlaiming tax deductions can get complicated. Form 1040-NR (The federal tax return for expat teachers). Form 1040-SR (The federal tax return for seniors), Schedule 1. Form 1040 (The standard federal tax return), Schedule 1. If you have determined you’re eligible to claim the educator expense deduction, do so on one of the following tax forms: Where to claim the educator expense deduction savings bonds if you’ve excluded this interest from your taxable income because it was used to pay for qualified higher education expenses. #EDUCATOR EXPENSES 2020 SERIES#

The deduction is limited to the sum of your teaching expenses that is greater than the interest earned on Series EE or U.S. #EDUCATOR EXPENSES 2020 PROFESSIONAL#

You should subtract tax-advantaged funds used for your own personal schooling or professional development courses, such as a Coverdell education savings account from your deduction.

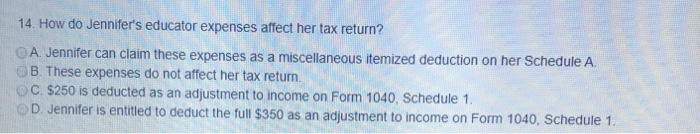

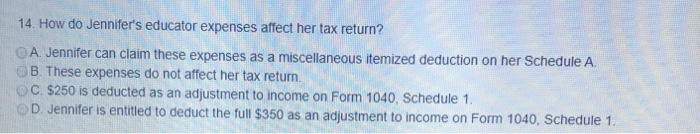

In fact, the deduction could be lowered due to a number of factors: There are a few additional limitations to the educator expense you should be mindful of. Other limitations of the educator expense deduction Unfortunately, the educator expense deduction doesn’t apply to homeschooling instructors, or any college professor or instructor in post-secondary learning environments. In addition to the roles listed above, you must spend at least 900 hours within an academic year providing elementary or secondary education as specified under your state’s law. Who’s eligible for teacher tax deductions?īefore assessing which teaching supplies fall under the educator expense deduction umbrella, you must first verify if you are what the IRS acknowledges as an “eligible educator.”Īn “eligible educator” describes anyone in the following roles for kindergarten through 12th-grade students: Supplementary materials used in the classroom.Professional development courses related to curriculum or students.Instructional supplies (like pens, paper, craft goods, etc.).Computer equipment, software, and cloud services.Common teacher classroom supplies that fit the tax deduction include:

0 kommentar(er)

0 kommentar(er)